IRS Issues Final Warning To File 2021 Tax Returns By April 15, 2025 Or Lose Your $1,400 Stimulus Check For Good – Financial Freedom Countdown

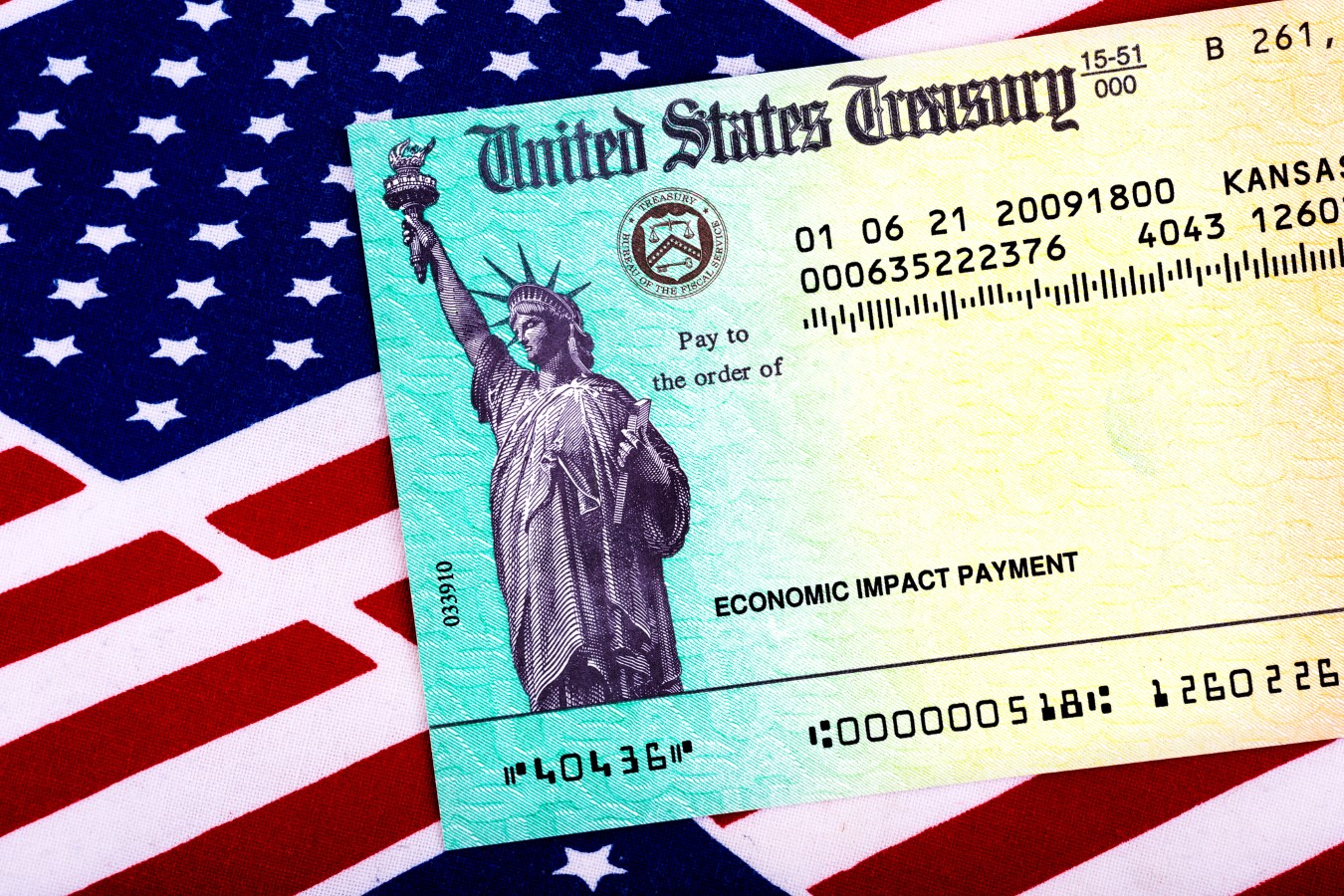

The Internal Revenue Service (IRS) has issued a reminder for eligible individuals to file their 2021 tax return within the next 5 days if they have yet to claim the Recovery Rebate Credit.

This refundable credit applies to those who missed the third and final round of stimulus payments distributed under the American Rescue Plan Act of 2021.

However, individuals who qualify but fail to submit their 2021 tax return by April 15, 2025—Tax Day—risk losing their chance to receive the stimulus payment permanently.

IRS Already Began Sending Out Checks in January

The IRS is set to deliver long-overdue stimulus payments to nearly 1 million Americans who missed out during the 2021 tax filing season.

By late January, the agency started issuing $2.4 billion in “special payments” of up to $1,400 per person to address previous omissions.

However, not everyone will qualify, leaving many Americans wondering if they’ll be among the fortunate to receive this financial relief.

How Much Money Is the IRS Sending to Taxpayers?

The IRS has allocated $2.4 billion for these payments, with eligible taxpayers receiving a maximum of $1,400 per individual.

Who Is Eligible for the ‘Special Payment’?

During the 2020-2021 period, Congress approved three rounds of stimulus checks: $1,200 in the first round, $600 in the second, and $1,400 in the final distribution.

Anyone who didn’t receive the full amounts but qualified was able to claim a rebate credit on their tax returns. The IRS identified approximately 1 million individuals from 2021 who fall into this category.

How Do I Calculate My Payment?

To calculate the amount of Recovery Rebate Credit, taxpayers may access their IRS Online Account to determine the amount they received in Economic Impact Payment(s).

Single taxpayers who filed their 2021 tax returns without claiming dependents and earned less than $80,000 are eligible to receive at least a portion, if not the full amount, of the $1,400 payment.

Married couples who filed jointly must have had a combined income of less than $160,000 to qualify for some or all of the credit.

Meanwhile, individuals who filed as the head of household with incomes below $112,500 are also eligible.

However, if you were claimed as a dependent on someone else’s 2021 tax return, you will not qualify for this special IRS payment.

Do You Need to Apply for the Unclaimed Stimulus Check?

No action is required to receive the payment if you filed your taxes.

The IRS will automatically send checks or deposit funds directly into the bank accounts listed on 2023 tax returns. If an account has been closed, the IRS will reissue the payment as a check.

However, individuals who qualify but fail to submit their 2021 tax return by April 15, 2025—Tax Day—risk losing their chance to receive the stimulus payment permanently.

When Will the Payments Arrive?

The payments for those who filed their tax returns were distributed throughout December and January. The IRS also sent letters to notify taxpayers about their payments.

However, individuals who qualify but fail to submit their 2021 tax return by April 15, 2025—Tax Day—risk losing their chance to receive the stimulus payment permanently if they do not file their tax returns.

What If You Didn’t File Your 2021 Tax Return?

If you missed filing your 2021 tax return, you may still be eligible to claim the rebate credit. The deadline to submit the return and secure this payment is April 15, 2025.

These upcoming payments mark an effort to close lingering gaps in stimulus distribution. However, they also underscore a broader challenge in ensuring that millions of Americans are adequately supported during economic crises.

Check the official IRS notification for more details.

Like Financial Freedom Countdown content? Be sure to follow us!

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

Dreaming of retiring to a sun-drenched beach or a quaint village? Many Americans envision spending their golden years abroad, savoring the delights of new cultures and landscapes. However, an essential part of this dream hinges on the financial stability provided by Social Security benefits. Before packing your bags and bidding farewell, it’s crucial to know that not all countries play by the same rules when it comes to collecting these benefits overseas. Here are the nine countries where your dream of retiring abroad could hit a snag, as Social Security benefits don’t cross every border. Avoid living in these countries so your retirement plans don’t get lost in translation.

Retire Abroad and Still Collect Social Security? Avoid These 9 Countries Where It’s Not Possible

What SECURE Act 2.0 Means for Your Future Retirement Plan

Three years on from the groundbreaking SECURE Act, which revolutionized America’s retirement landscape for the first time in a decade, the SECURE Act 2.0 sequel legislation aims to widen the gateway to retirement plans and benefits, introducing pivotal changes like automatic enrollment in select workplace pensions, increased catch-up contributions for the seasoned workforce, and extended retirement saving opportunities for part-time employees. Moreover, it promises to bolster individuals’ ability to set aside emergency funds, ensuring swift access in times of need, marking another significant stride toward securing a more financially stable future for all. Here are some of the key provisions.

What SECURE Act 2.0 Means for Your Future Retirement Plan

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Countless systems have been established that provide a much better understanding of what income generation is, how it can be used, and how individuals can organize their financial life as they work towards financial freedom. One of the more successful and better-known examples of financial education is the Cashflow Quadrant, the book by Robert Kiyosaki. Rich Dad’s Cashflow Quadrant was revolutionary for the way it organized money and helped people better learn how to increase their income. As the name implies, there are four quadrants within the Cashflow Quadrant. By mastering each of the four categories – or specializing in one – a person can increase their revenue stream and ultimately make more money.

Shift From Employee to Investor Mindset with the Cashflow Quadrant Methodology by Robert Kiyosaki

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

Small towns across the US are offering free land for those ready to build homes and contribute to their communities. As housing costs soar nationwide, these towns are innovating to attract new residents and revitalize their local economies. From the Midwest to the Mountain states, these programs offer more than just affordable homeownership; they invite you to join a tight-knit community and embrace a whole new way of life.

Exploring Government Programs Granting Free Land for Affordable Homeownership: From Colorado to Iowa

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Give the article a Thumbs Up on the top-left side of the screen.

3. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.