Do You Understand Your Health Insurance?

To make Wealthtender free for readers, we earn money from advertisers, including financial professionals and firms that pay to be featured. This creates a conflict of interest when we favor their promotion over others. Read our editorial policy and terms of service to learn more. Wealthtender is not a client of these financial services providers.

➡️ Find a Local Advisor | 🎯 Find a Specialist Advisor

Understanding health insurance is hard, leading Americans to spend too much on healthcare with outcomes worse than many developed countries.

As Americans, we should all be outraged.

According to a Commonwealth Fund report, “The U.S. is a world outlier when it comes to health care spending,” yet we don’t get what we’re paying for – better health outcomes.

We Pay More for Health Insurance to Get Less

In 1980, we were already at the high end of developed economies, at 8.2% of Gross Domestic Product (GDP). But the latest data show we’ve more than doubled that since, to 17.8%.

Germany, in second place, spends just 12.8% of its (far lower) GDP, while the average for the 12 non-US developed countries stands at 11.1%.

The report states that in absolute dollar terms, “Health spending per person in the U.S. was nearly two times higher than in the closest country, Germany, and four times higher than in South Korea.”

And lest you think this means we get better health outcomes, the report shows life expectancy in the US, at 77, is lower than all 12 of those other countries. The next lowest was the UK, at 80.4, and the average was 82.6, over five years longer than us.

In terms of avoidable deaths, the US leads the pack, by a lot. According to the most recent data, for 2020, we had 336 avoidable deaths per 100,000 population – in absolute numbers that was a heart-wrenching 1.1 million American lives needlessly lost.

Even before the Covid-19 pandemic, we lost 273 lives per 100,000, for a total of nearly 900,000 whose deaths were preventable.

In 2020, the next highest, Germany, stood at 195 per 100,000, 42% lower than us; while in 2019 their number was over 30% lower than us, at 188.

We Don’t Fully Understand Our Health Insurance

According to the Commonwealth Fund report, “The U.S. is the only high-income country that does not guarantee health coverage.”

And even when we do have health insurance, it’s expensive, often hard to navigate and make informed choices, and even when we buy it, insurers regularly deny coverage even for covered conditions, knowing only 1 in 500 who get denied will challenge them.

Indeed, according to a KFF study, “Insurers of qualified health plans (QHPs) sold on HealthCare.gov denied 19% of in-network claims in 2023 and 37% of out-of-network claims for a combined average of 20% of all claims… The in-network denial rate ranged from 1% to 54%.”

Another study, the 2024 Consumer Engagement in Health Care Survey (CEHCS), surveying more than 2000 adults aged from 21 to 64, was conducted by the Employee Benefit Research Institute (EBRI) and Greenwald Research.

This survey found that most of us who buy health insurance do understand two things:

- Premium, what we pay even if we never file a single claim (known by 86%)

- Deductible, how much we have to spend on a specific claim before insurance kicks in their part (known by 82%)

However, the picture was far less rosy when they asked about the following:

- Prescription drug copays, the percentage of the cost of drugs we have to pay (after satisfying the deductible), which percentage varies for different tiers of drugs (known by just 1 in 4; more on that below)

- Maximum out of pocket limit, the most we’d have to pay ourselves in a policy year even under the most catastrophic conditions, including deductibles, copays, and coinsurance amounts (just over 1 in 5 were able to correctly answer three of four questions)

Given how expensive it is to get health coverage, you’d think we’d put a good deal of time and effort to fully understand our options before picking which plan we sign up for.

You’d think, but you’d be wrong.

During open enrollment, according to the CEHCS, most of us spend less than 2 hours before making our choice, half of us spend under an hour, and 30% spend less than 30 minutes!

Who Can Help Solve This?

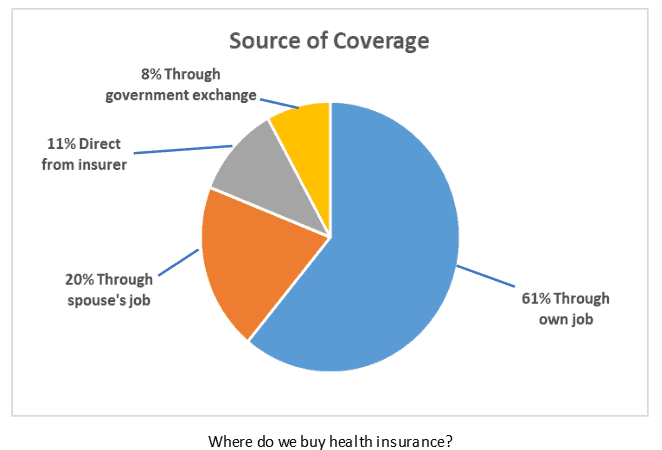

More than 4 in 5 Americans get health insurance through an employer: 61% our own employer and 20% via a spouse’s employer.

While it’s really our responsibility to make sure we fully understand our health insurance options before picking one, the sad fact is that many of us don’t do a good job of that.

This is where employers, through their benefits team, can step up and educate their employees.

Dale Ratner Hershman, Principal Sick Advisory Services, offers some advice for people making a good, but not spectacular, living. He says, “Middle-class entrepreneurs are in the toughest spot in terms of health insurance. People with very low income can get Medicaid and/or Affordable Care Act (ACA) plans, and families that make $300,000 a year or more are simply rich enough to afford even the most outrageous monthly premiums. But a family of four that earns roughly $125,000 may be faced with monthly healthcare premiums of $2,000 or more. This is BEFORE we even consider deductibles or co-pays.

“There are a few tactics to avoid this predicament… (a) Sometimes, one spouse will continue to work a corporate job while the other pursues entrepreneurship. The employed spouse can then cover the whole family on her corporate health insurance. (b) Some employers, such as Apple, offer excellent, affordable health insurance, even for part-time employees. (c) A clever entrepreneur may be able to tailor her taxable income so as to be, “not too poor, but not too rich” to qualify for discounted healthcare. (d) Depending on where you live and your comfort with international travel, you may be able to get excellent care at much better prices by flying abroad. For example, a top-quality dental procedure that costs $10,000 in South Florida, may cost less than $1,500 in Colombia, which is an easy three-hour flight away. The healthcare situation for the self-employed is not pretty in the United States, but with proper planning and a proactive attitude, you can get by.”

The Prescription Cost Problem

However, even the most astute and dedicated of us simply can’t get at the data we need.

For example, coming back to prescription drug tiers, according to the Medical University of South Carolina (MUSC), drug pricing is seriously opaque.

For most products, the provider tells the consumer what they’ll get and how much they need to pay. This price will cover the cost of manufacturing and the manufacturer’s profit, transportation costs and other costs for the retailer along with that retailer’s profit.

With prescription drugs, however, things are not so straightforward.

As the MUSC article says, “Pharmacy benefit managers (PBMs) act as intermediaries between the drug manufacturers and the insurance companies. PBMs negotiate rebates from the drug manufacturers, which lower the cost that insurance companies must pay for medications. In return, the medication is moved up on the formulary list – a catalog of prescription medications covered by a specific insurance plan. Formulary lists are typically organized into tiers and moving a medication up reduces the copay patients are responsible for, driving higher sales. The higher the rebate paid by the drug company, the higher up on the formulary the medication is moved and the more likely patients will fill their prescriptions for the medication.

“These rebates are shrouded in secrecy. The exact amounts of these rebates and the cuts taken by the PBMs are not publicly disclosed. However, drug manufacturers often cite this system as the reason that they continuously raise drug prices.”

The Best Use of Health Savings Accounts

Health Savings Accounts (HSAs), are arguably the best tax-advantaged plan in the US. This is the only account type that has a triple tax advantage:

- Contributions (up to IRS annual limits) are fully tax deductible, no matter how much you earn.

- Within the account (if you choose the right HSA), you can invest your contributions in mutual funds, and the growth of your HSA money isn’t taxable.

- When you withdraw money for qualified health-related costs, whether in the year you contributed or in retirement, those withdrawals are tax-free.

The one caveat is that you must be eligible for an HSA. Per the IRS, to be eligible:

- You have to be covered by a High-Deductible Health Plan (HDHP) on the first day of the month

- You can have no other health coverage (with some limited exceptions)

- You cannot be enrolled in Medicare

- You can’t be claimed as a dependent on someone else’s tax return

What counts as an HDHP? The IRS says:

- It must have a higher annual deductible than typical health plans

- It must have a maximum limit on the sum of the annual deductible and out-of-pocket medical expenses that you must pay for covered expenses. Out-of-pocket expenses include co-payments and other amounts, but don’t include premiums.

As Ryan P. McGonigal, Founder of RPM Financial Group LLC says, “Clients need better education on their employer-provided benefits to fully leverage them. For example, if you’re single and rarely see a doctor, a high-deductible health plan (HDHP) with lower premiums might be the best option. You can then use the money saved on premiums to contribute to your employer’s Health Savings Account (HSA). Why? HSA contributions are pre-tax, grow tax-deferred, and can be withdrawn tax-free for qualified medical expenses. This approach helps you maximize your health benefits at a lower cost. Understanding these options empowers employees to make smarter choices and save money.”

Jason Gilbert, Managing Partner, RGA Investment Advisors, agrees, “I wish more people knew that their Health Savings Account (HSA) is not just a spending account—it can be a powerful long-term investment vehicle. If you’re eligible, maxing out your HSA contributions and investing those funds can create a tax-advantaged safety net for healthcare expenses in retirement, where medical costs tend to rise significantly.”

Note that not all employers’ HSAs have investment options. Some offer just an interest-paying savings account. However, even if you get an HSA-compliant health plan through your employer, you’re not obligated to use the employer’s HSA. For example, I like Optum Bank’s HSA (this isn’t intended as an endorsement — do your own due diligence before picking the right HSA for you.

Clearly, the best way to take advantage of an HSA is to contribute each year the full amount allowed, invest the money in growth-oriented assets such as stock mutual funds, and let the money grow tax-free until you retire. Then, you can use the much higher amount the account holds by that point to cover the (high) medical expenses you’ll incur as you age.

According to the CECHS, nearly 2 in 3 consider the HSA as a savings account, possibly because that’s what the “S” in the middle stands for. Another 19% view it as a checking account.

Two-thirds use the money in the account to cover health-related expenses in the year they made the contribution or shortly thereafter. Sadly, fewer than 4 in 10 consider their HSA an investment account to be used for healthcare in retirement.

Smart Health Technology

Finally, the CEHCS states that 62% of those surveyed reported using smart health technology (e.g., wearable devices and/or apps that can sense or track activities to help manage and improve health), and over 4 in 10 use it currently.

About 3 in 4 agreed that such smart health technology makes it easier to access care, but 2 in 3 said they wish they could share the data collected by such technology with their doctor. Six in 10 said they wished they could share it with their health insurance provider.

The Future of Health Insurance

Arguably, the best thing you can do for your future self is to stay as healthy as possible as you age.

Getting the best health insurance can help achieve that goal. Unfortunately, too many of us don’t dedicate enough time to educating ourselves about our options, and even those who do so often run into problems such as denied claims and opaque pricing.

Kevin Estes, founder and financial planner of Scaled Finance agrees, “Having the right insurance takes priority. Don’t let the tax tail wag the healthcare dog! Paying a higher premium and less out of pocket may be better for someone with ongoing medical expenses. If a high-deductible plan is best, then consider a Health Savings Account (HSA). Many people overestimate future healthcare premiums. Both exchange plans and Medicare are based on income, not wealth. The cost of medical treatment is the bigger unknown.”

Gilbert adds, “Many of my clients have the assets to weather medical costs, but they don’t always realize how much strategic planning, whether through insurance selection, tax-advantaged accounts, or investment strategies, can improve their long-term financial security. A well-structured financial plan doesn’t just focus on growing wealth; it ensures that when health issues arise, they don’t derail financial goals.”

Given our lack of information, it’s no wonder that, as a country, we spend too much on healthcare and get poorer outcomes than other developed countries that spend far less.

Disclaimer: This article is intended for informational purposes only, and should not be considered financial advice. You should consult a financial professional before making any major financial decisions.

About the Author

Opher Ganel, Ph.D.

My career has had many unpredictable twists and turns. A MSc in theoretical physics, PhD in experimental high-energy physics, postdoc in particle detector R&D, research position in experimental cosmic-ray physics (including a couple of visits to Antarctica), a brief stint at a small engineering services company supporting NASA, followed by starting my own small consulting practice supporting NASA projects and programs. Along the way, I started other micro businesses and helped my wife start and grow her own Marriage and Family Therapy practice. Now, I use all these experiences to also offer financial strategy services to help independent professionals achieve their personal and business finance goals. Connect with me on my own site: OpherGanel.com and/or follow my Medium publication: medium.com/financial-strategy/.